- ✅ WON @ 2.80 – L Musetti – ATP Miami – Sun 23 March 2025 (Club P/L Report)

- ATP Miami 2025: Deep Dive Analysis of the betting opportunities

- ✅ WON @ 2.48 – F Comesana – ATP Miami – Mon 17 March 2025 (Club P/L Report)

- ✅ WON @ 3.65 (J Draper) – Sat 15 March – ATP Indian Wells 2025

- ✅ WON @ 4.20 (T Griekspoor) – Fri 07 March 2025 – Club P/L Report

- ✅ WON @ 2.16 – M Gigante – ATP Indian Wells – Thu 06 March 2025 (Club P/L Report)

The traditional bookmaker offers a product that nobody would typically buy. Their offering is ‘Send us £1 and we’ll return £0.95’. This is based on the general margin / edge of 5% across sportsbooks and casino games although it can be both significantly better and worse than this in certain situations.

Whether the customer places a bet, plays a slot machine or spins the roulette wheel the bookmaker (house) has an edge. Typically of a few percent as stated earlier. So every person doing this is trading their money for slightly less money. Of course this is long term – it’s possible to win signficiant amounts in a single session and equally lose vast sums. Never risk more than you can afford to lose – Gamble Aware is a vital resource.

Focus: Sports Betting

Let’s illustrate this with an example from the world of tennis (it seems appropriate as that’s kinda our thing). There is a match between ‘Player A’ and ‘Player B’. The bookmakers traders have calculated that each player has the exact same chance of winning (i.e 50%).

So what should the odds be for both players to win? 1/1 (2.00). However, have you ever seen a bookmaker offering evens or above on both sides of the line? Probably not. If so, their traders should be fired, as they would not make a profit from that market long term. Instead bookmakers take the actual odds (based on implied probability) and then add their margin which varies from bookmaker to bookmaker. Marathonbet and Pinnacle will only reduce it by 2-3% on average whereas lower quality bookmakers will often apply a margin in excess of 5%. Larger events typically have a higher payout as bookmakers need to be more competitive.

What odds will the punter actually get? In the scenario above it would most likely be 1.80 – 1.95 or close that range. So although the match is essentially a coin flip – they are paying out slightly less and lets how they make a profit. It may not seem much but imagine it amplified over turnover of millions of even billions when considering the worldwide sports betting market.

Where do Exchanges come in?

The concept of an exchange is to match customers. The market liqusity is provided by others with a different opinion. So in the example above one person may think Player A will win and another Player B. The exchange brings them together. The person who predicts it correctly walks away with the money. No bookmaker margins – fair odds that actually reflect real probability. So what’s the issue? In a word, the dreaded – commission.

Exchanges offer the same coverage as bookmakers in terms of the matches and events however some bookmakers still have the edge in terms of speciality markets. Often exchanges don’t offer the more complex handicap markers or ‘total aces’ (for example) on tennis due to the projected lack of liquidity.

Why use Betting Exchanges?

Sports betting is one of the few forms of gambling where it’s possible to gain an edge. Roulette has a fixed house edge and there is nothing the player can do to alter this. However with sports betting an educated bettor can disagree with the bookmakers traders regarding an outcomes projected probability. This individual may still struggle to profit consistently due to excessive bookmaker margins but on an exchange he or she doesn’t have to worry about this. Just the commission on profit of 2-5% which is relatively easy to overcome. There is also a ‘Premium Charge’ for those who place large bets and meet certain profit thresholds.

Crucially though; an exchange will not close or limit your account for profiting long term, it will not charge a margin through its odds only commission and it will increase your profit by 10-15% on average. For an individual who’s serious about sports betting this a no brainer.

Remember to track all bets to clearly monitor profit/loss, liability, ROI and other essential statistics with a reliable platform such as Betting Metrics.

Liquidity: Significant Issue?

Generally – the short answer is no. Large tennis events have more than enough money going through the market to satisfy the needs of virtually all bettors. Those using extremely large stakes may struggle. Betfair is the largest exchange with the highest average market liquidity.

Tennis Tips UK Club – Results Synopsis – Updated March 2025

TENNIS TIPS UK CLUB MEMBERSHIP – How it Works

TENNIS TIPS UK CLUB MEMBERSHIP – How it Works

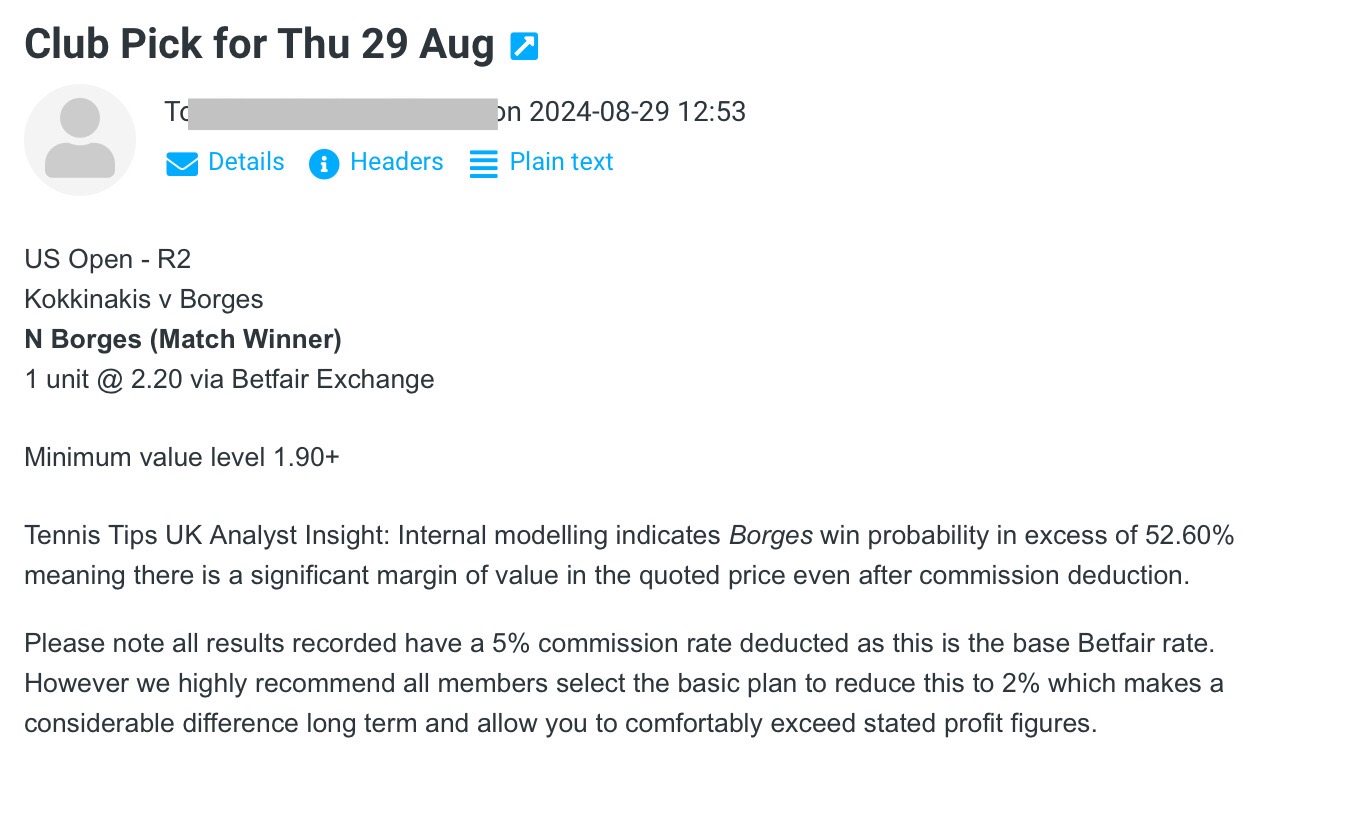

Follow @TennisTipsUKSynopsis: An email service where members receive regular betting picks direct to their inbox. This clearly states the match, specific bet and advised stake. There is no subscription so simply stay as long as you want. The number of members is capped so sometimes a waiting list is activated. All advisory of this type is exclusive to paid members.

Who picks the advised bets?Tennis Tips UK have a team of analysts built over the past decade. Each has shown a proficiency in beating ATP, Challenger or Grand Slam markets consistently. See an example of the email format members receive below.

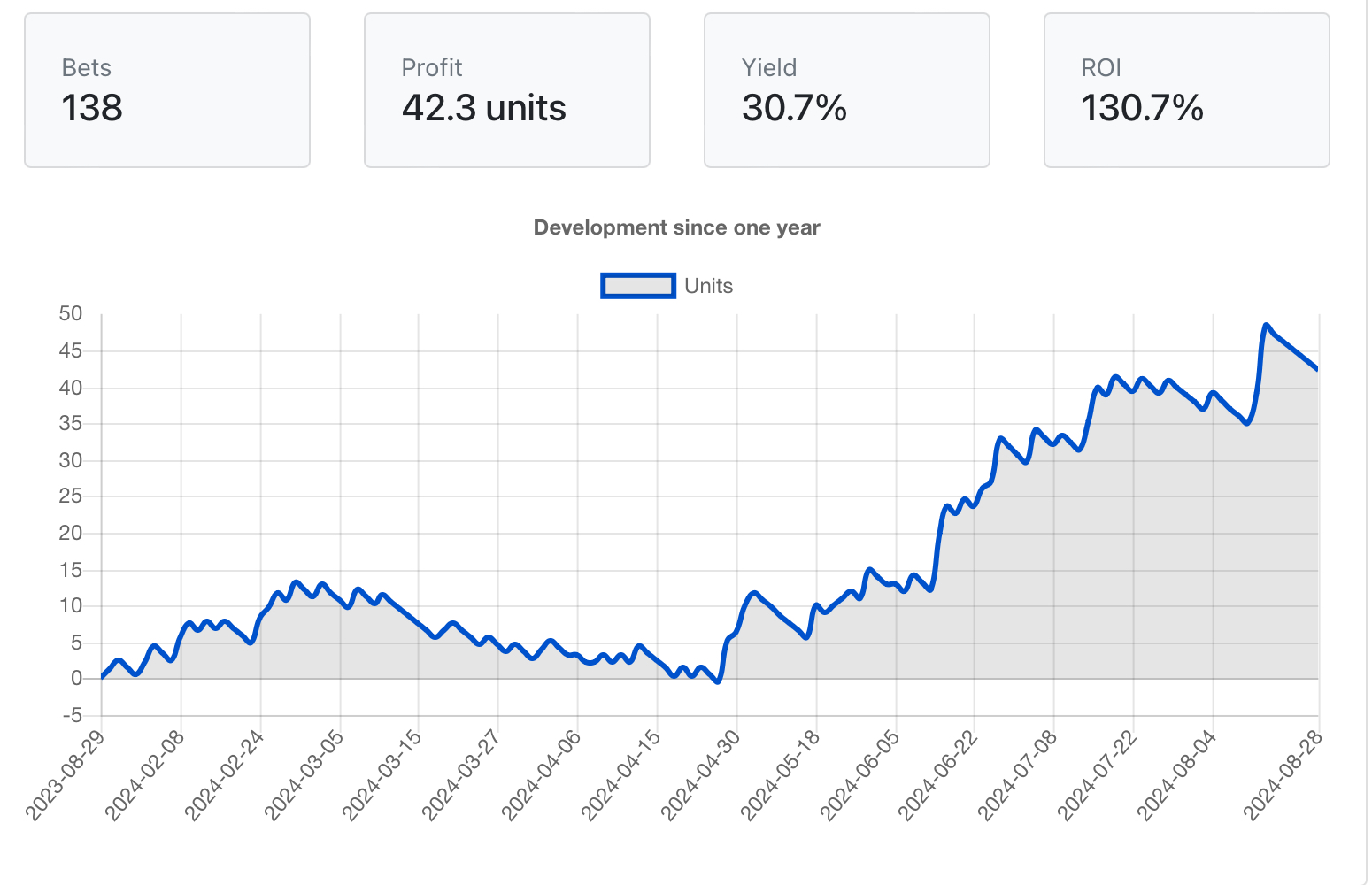

How much profit have the picks made overall?Full tracking is available publicly via a third party verification platform. However there are multiple club members attaining four figure profit sums each month simply by following the advised bets using their bookmaker and exchange accounts.

As of late 2024; a £100 bettor has enjoyed profits in excess of £4230 assuming they backed the quoted price using an exchange with 5% commission deducted. In reality most club members pay a lower rate and as such have a higher profit attainment.How can I get access?Club membership is currently open to applications. Subscribers can expect to receive picks most days that the primary tours are active. These will be match winner or games handicap bets priced at 2.00 or above covering ATP, Challenger or Grand Slam matches.

How do you profit from tennis betting?There is no single ‘one size fits all’ approach. Tennis Tips UK have been fine tuning the selection process since way back in 2013. For a comprehensive insight into our thesis try exploring our tennis betting research articles.

Are there any third party tipsters you recommend?There is a tipster network that has received positive comments from most of our members. It’s by no means perfect. There are many tipsters there you should avoid but some offering genuine value. Most rely on bookmaker prices that will limit you quickly though so try and instead focus on the services that quote exchange prices.

Looking to join the club? – 9/10 Places Reserved

Highest Rated Tennis Betting Tools & Resources

BettingGods.com – Far from perfect but certainly one of the best when it comes to transparency. Their tipsters quoted results in terms of profit and yield are accurate and the odds quoted obtainable for the average punter. There are often trials and discounts available so always try and use them where possible. It’s also good to know they offer a no questions asked refund policy.

TopTennisTips.com – A pioneer in terms of using data driven models and AI to profit from tennis betting. Packages are on the expensive side though so you’ll need a relatively large initial bankroll to make it viable. Many of the Tennis Tips UK club members have reported significant profits though so worth a look.

Discover more from TENNIS TIPS UK

Subscribe to get the latest posts sent to your email.